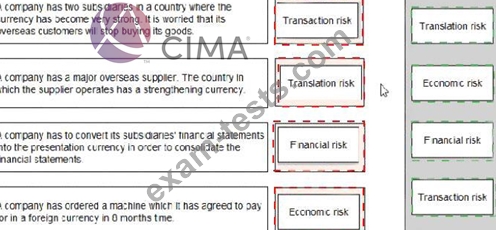

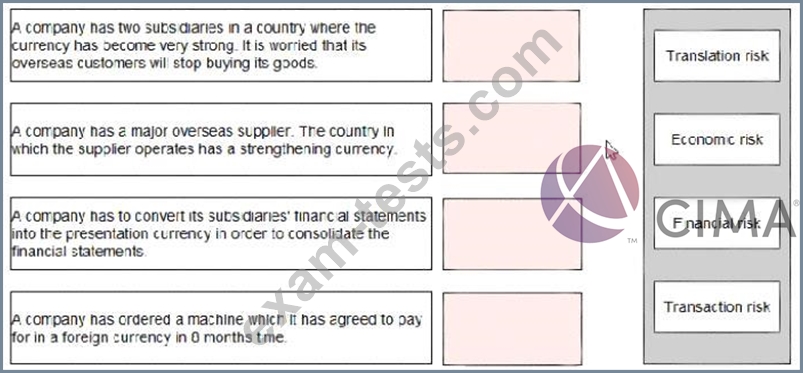

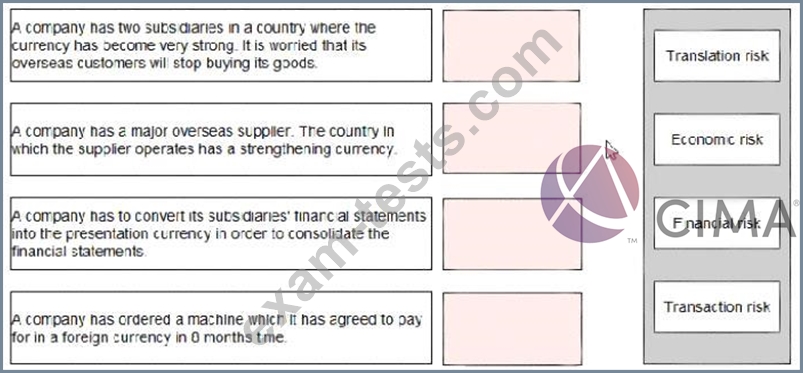

Question 61

Select the category of risk for each of the descriptions below:

Question 62

A listed company plans to raise $350 million to finance a major expansion programme.

The cash flow projections for the programme are subject to considerable variability.

Brief details of the programme have been public knowledge for a few weeks.

The directors are considering two financing options, either a rights issue at a 20% discount to current share price or a long term bond.

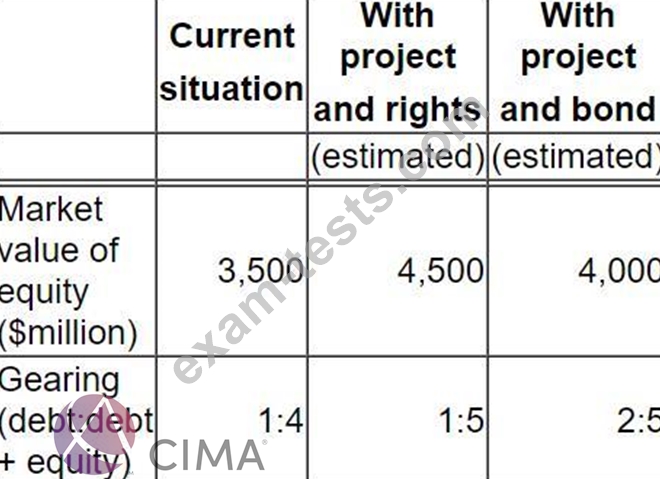

The following data is relevant:

The company's share price has fallen by 5% over the past 3 months compared with a fall in the market of 3% over the same period.

The directors favour the bond option.

However, the Chief Accountant has provided arguments for a rights issue.

Which TWO of the following arguments in favour of a right issue are correct?

The cash flow projections for the programme are subject to considerable variability.

Brief details of the programme have been public knowledge for a few weeks.

The directors are considering two financing options, either a rights issue at a 20% discount to current share price or a long term bond.

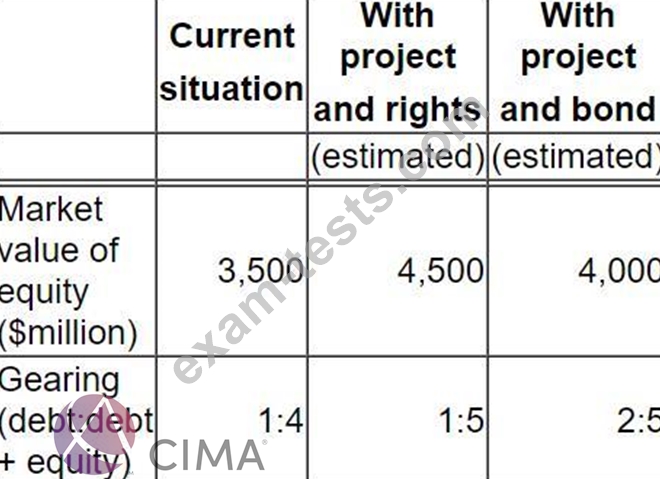

The following data is relevant:

The company's share price has fallen by 5% over the past 3 months compared with a fall in the market of 3% over the same period.

The directors favour the bond option.

However, the Chief Accountant has provided arguments for a rights issue.

Which TWO of the following arguments in favour of a right issue are correct?

Question 63

An all equity financed company reported earnings for the year ending 31 December 20X1 of $5 million.

One of its financial objectives is to increase earnings by 5% each year.

In the year ending 31 December 20X2 it financed a project by issuing a bond with a $1 million nominal value and a coupon rate of 7%.

The company pays corporate income tax at 30%.

If the company is to achieve its earnings target for the year ending 31 December 20X2, what is the minimum operating profit (profit before interest and tax) that it must achieve?

One of its financial objectives is to increase earnings by 5% each year.

In the year ending 31 December 20X2 it financed a project by issuing a bond with a $1 million nominal value and a coupon rate of 7%.

The company pays corporate income tax at 30%.

If the company is to achieve its earnings target for the year ending 31 December 20X2, what is the minimum operating profit (profit before interest and tax) that it must achieve?

Question 64

XYZ has a variable rate loan of $200 million on which it is paying interest of Liber ' 3%.

XYZ entered into a swap with AG bank to convert this to a fixed rate 8% loan. AB bank charges an annual commission of 0.4% for making this arrangement Calculate the net payment from KYZ to AB bank at the end of the first year if Libor was 2% throughout the year.

Give your answer in $ million, to one decimal place.

XYZ entered into a swap with AG bank to convert this to a fixed rate 8% loan. AB bank charges an annual commission of 0.4% for making this arrangement Calculate the net payment from KYZ to AB bank at the end of the first year if Libor was 2% throughout the year.

Give your answer in $ million, to one decimal place.

Question 65

A private company was formed five years ago and is currently owned and managed by its five founders. The founders, who each own the same number of shares have generally co-operated effectively but there have also been a number of areas where they have disagreed The company has grown significantly over this period by re-investing its earnings into new investments which have produced excellent returns The founders are now considering an Initial Public Offering by listing 70% of the shares on the local stock exchange Which THREE of the following statements about the advantages of a listing are valid?