Question 71

A company plans a four-year project which will be financed by either an operating lease or a bank loan.

Lease details:

* Four year lease contract.

* Annual lease rentals of $45,000, paid in advance on the 1st day of the year.

Other information:

* The interest rate payable on the bank borrowing is 10%.

* The capital cost of the project is $200,000 which would have to be paid at the beginning of the first year.

* A salvage or residual value of $100,000 is estimated at the end of the project's life.

* Purchased assets attract straight line tax depreciation allowances.

* Corporate income tax is 20% and is payable at the end of the year following the year to which it relates.

A lease-or-buy appraisal is shown below:

Which THREE of the following items are errors within the appraisal?

Lease details:

* Four year lease contract.

* Annual lease rentals of $45,000, paid in advance on the 1st day of the year.

Other information:

* The interest rate payable on the bank borrowing is 10%.

* The capital cost of the project is $200,000 which would have to be paid at the beginning of the first year.

* A salvage or residual value of $100,000 is estimated at the end of the project's life.

* Purchased assets attract straight line tax depreciation allowances.

* Corporate income tax is 20% and is payable at the end of the year following the year to which it relates.

A lease-or-buy appraisal is shown below:

Which THREE of the following items are errors within the appraisal?

Question 72

Which of the following statements are true with regard to interest rate swaps?

Select ALL that apply.

Select ALL that apply.

Question 73

Which THREE of the following are likely to be strategic reasons for a horizontal acquisition?

Question 74

A listed company is planning a share repurchase.

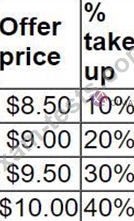

Research into different offer prices has given the following data with regards acceptance by the shareholders at different prices:

What price should be offered to shareholders if the retained earnings of the company are to remain unchanged?

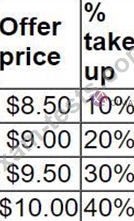

Research into different offer prices has given the following data with regards acceptance by the shareholders at different prices:

What price should be offered to shareholders if the retained earnings of the company are to remain unchanged?

Question 75

A government is currently considering the privatisation of the national airline. The shares are to be offered to the public via a fixed price Initial Public Offering (IPO).

Which THREE of the following statements are correct?

Which THREE of the following statements are correct?