Question 96

A company currently has a 5.25% fixed rate loan but it wishes to change the interest style of the loan to variable by using an interest rate swap directly with the bank.

The bank has quoted the following swap rate:

* 4.50% - 455% in exchange for Libor

Libor is currently 4%.

If the company enters into the swap and Libor remains at 4%. what will the company's interest cost be?

The bank has quoted the following swap rate:

* 4.50% - 455% in exchange for Libor

Libor is currently 4%.

If the company enters into the swap and Libor remains at 4%. what will the company's interest cost be?

Question 97

A company is based in Country Y whose functional currency is YS. It has an investment in Country Z whose functional currency is ZS This year the company expects to generate ZS20 million profit after tax.

Tax Regime

* Corporate income tax rate in Country Y is 60%

* Corporate income tax rate in Country Z Is 30%

* Full double tax relief is available

Assume an exchange rate of YS1 = ZS5

What is the expected profit after tax in YS if the ZS profit is remitted to Country Y?

Tax Regime

* Corporate income tax rate in Country Y is 60%

* Corporate income tax rate in Country Z Is 30%

* Full double tax relief is available

Assume an exchange rate of YS1 = ZS5

What is the expected profit after tax in YS if the ZS profit is remitted to Country Y?

Question 98

A company generates operating profit of $17.2 million, and incurs finance costs of $5.7 million.

It plans to increase interest cover to a multiple of 5-to-1 by raising funds from shareholders to repay some existing debt. The pre-tax cost of debt is fixed at 5%, and the refinancing will not affect this.

Assuming no change in operating profit, what amount must be raised from shareholders?

Give your answer in $ millions to the nearest one decimal place.

It plans to increase interest cover to a multiple of 5-to-1 by raising funds from shareholders to repay some existing debt. The pre-tax cost of debt is fixed at 5%, and the refinancing will not affect this.

Assuming no change in operating profit, what amount must be raised from shareholders?

Give your answer in $ millions to the nearest one decimal place.

Question 99

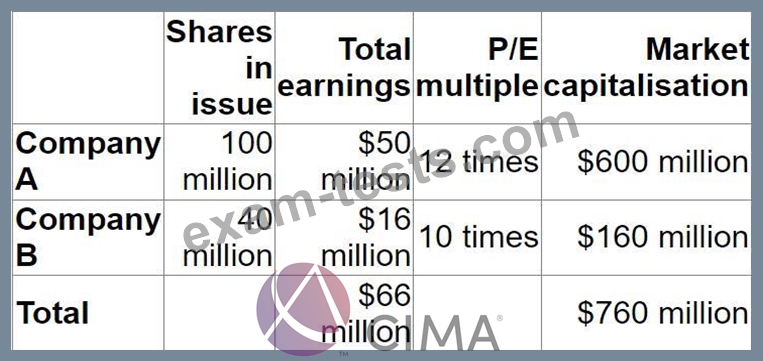

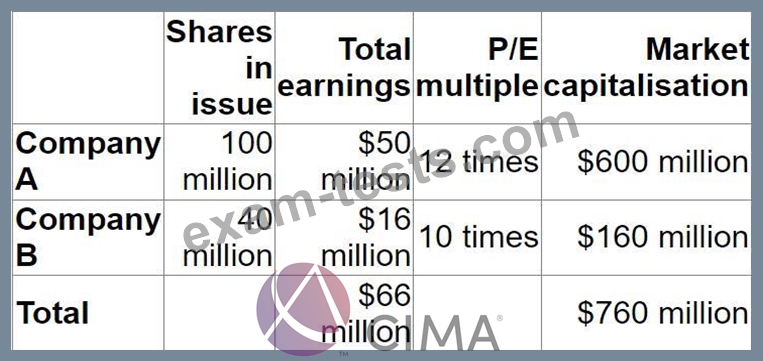

Company A plans to acquire Company B in a 1-for-1 share exchange.

Pre-acquisition information is as follows:

Post-acquisition information is as follows:

* Annual earnings are expected to increase by $4 million.

* The P/E multiple of the combined company is expected to be 12 times.

If the acquisition proceeds, what is the expected percentage increase in the post acquisition share price of Company A?

Pre-acquisition information is as follows:

Post-acquisition information is as follows:

* Annual earnings are expected to increase by $4 million.

* The P/E multiple of the combined company is expected to be 12 times.

If the acquisition proceeds, what is the expected percentage increase in the post acquisition share price of Company A?

Question 100

A company is deciding whether to offer a scrip dividend or a cash dividend to its shareholders.

Although the company has excellent long-term growth prospects, it is experiencing short-term profit and cash flow problems.

Which of the following statements is most likely to be a reason for choosing the scrip dividend?

Although the company has excellent long-term growth prospects, it is experiencing short-term profit and cash flow problems.

Which of the following statements is most likely to be a reason for choosing the scrip dividend?