Question 106

A company generates and distributes electricity and gas to households and businesses.

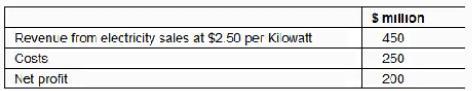

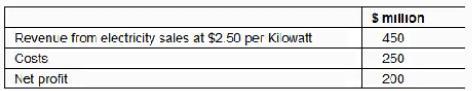

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $2.00 per Kilowatt.

The company expects this to cause consumption to rise by 15% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to:

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $2.00 per Kilowatt.

The company expects this to cause consumption to rise by 15% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to:

Question 107

Company W has received an unwelcome takeover bid from Company B.

The offer is a share exchange of 3 shares in Company B for 5 shares in Company W or a cash alternative of $5.70 for each Company W share.

Company B is approximately twice the size of Company W based on market capitalisation. Although the two companies have some common business interested the main aim of the bid is diversification for Company B.

Company W has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

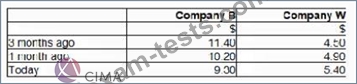

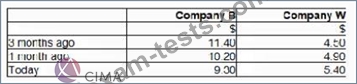

The following share price information is relevant.

Which of the following would be the most appropriate action by Company W's directors following receipt of this hostile bid?

The offer is a share exchange of 3 shares in Company B for 5 shares in Company W or a cash alternative of $5.70 for each Company W share.

Company B is approximately twice the size of Company W based on market capitalisation. Although the two companies have some common business interested the main aim of the bid is diversification for Company B.

Company W has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

The following share price information is relevant.

Which of the following would be the most appropriate action by Company W's directors following receipt of this hostile bid?

Question 108

Company A has a cash surplus.

The discount rate used for a typical project is the company's weighted average cost of capital of 10%.

No investment projects will be available for at least 2 years.

Which of the following is currently most likely to increase shareholder wealth in respect of the surplus cash?

The discount rate used for a typical project is the company's weighted average cost of capital of 10%.

No investment projects will be available for at least 2 years.

Which of the following is currently most likely to increase shareholder wealth in respect of the surplus cash?

Question 109

An entity prepares financial statements to 31 December each year. The following data applies:

1 December 20X0

* The entity purchased some inventory for $400,000.

* In order to protect the inventory against adverse changes in fair value the entity entered into a futures contract to sell the inventory for a fixed price on 31 January 20X1.

* The entity designated this contract as a fair value hedge of the value of the inventory.

31 December 20X0

* The inventory had a fair value of $480,000 and the futures contract had a fair value of $75,000 (a financial liability).

What will be the impact on the statement of profit or loss and other comprehensive income for the year ended

31 December 20X0 in respect of the change in the value of the inventory and the futures contract?

1 December 20X0

* The entity purchased some inventory for $400,000.

* In order to protect the inventory against adverse changes in fair value the entity entered into a futures contract to sell the inventory for a fixed price on 31 January 20X1.

* The entity designated this contract as a fair value hedge of the value of the inventory.

31 December 20X0

* The inventory had a fair value of $480,000 and the futures contract had a fair value of $75,000 (a financial liability).

What will be the impact on the statement of profit or loss and other comprehensive income for the year ended

31 December 20X0 in respect of the change in the value of the inventory and the futures contract?

Question 110

A company plans to raise $12 million to finance an expansion project using a rights issue.

Relevant data:

* Shares will be offered at a 20% discount to the present market price of $15.00 per share.

* There are currently 2 million shares in issue.

* The project is forecast to yield a positive NPV of $6 million.

What is the yield-adjusted Theoretical Ex-Rights Price following the announcement of the rights issue?

Relevant data:

* Shares will be offered at a 20% discount to the present market price of $15.00 per share.

* There are currently 2 million shares in issue.

* The project is forecast to yield a positive NPV of $6 million.

What is the yield-adjusted Theoretical Ex-Rights Price following the announcement of the rights issue?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: