Question 101

Company A is proposing a rights issue to finance a new investment. Its current debt to equity ratio is 10%.

Which TWO of the following statements are true?

Which TWO of the following statements are true?

Question 102

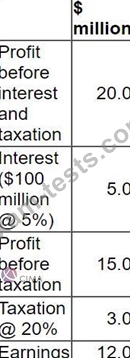

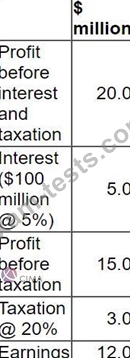

Extracts from a company's profit forecast for the next financial year as follows:

Since preparing the forecast, the company has decided to return surplus cash to shareholders by a share repurchase arrangement.

The share repurchase would result in the company purchasing 20% of the 1,250 million ordinary shares currently in issue and canceling them.

Assuming the share repurchase went ahead, the impact on the company's forecast earnings per share will be an increase of:

Since preparing the forecast, the company has decided to return surplus cash to shareholders by a share repurchase arrangement.

The share repurchase would result in the company purchasing 20% of the 1,250 million ordinary shares currently in issue and canceling them.

Assuming the share repurchase went ahead, the impact on the company's forecast earnings per share will be an increase of:

Question 103

Company A is unlisted and all-equity financed. It is trying to estimate its cost of equity.

The following information relates to another company, Company B, which operates in the same industry as Company A and has similar business risk:

Equity beta = 1.6

Debt:equity ratio 40:60

The rate of corporate income tax is 20%.

The expected premium on the market portfolio is 7% and the risk-free rate is 5%.

What is the estimated cost of equity for Company A?

Give your answer to one decimal place.

? %

The following information relates to another company, Company B, which operates in the same industry as Company A and has similar business risk:

Equity beta = 1.6

Debt:equity ratio 40:60

The rate of corporate income tax is 20%.

The expected premium on the market portfolio is 7% and the risk-free rate is 5%.

What is the estimated cost of equity for Company A?

Give your answer to one decimal place.

? %

Question 104

The ex div share price of a company's shares is $2.20.

An investor in the company currently holds 1,000 shares.

The company plans to issue a scrip dividend of 1 new share for every 10 shares currently held.

After the scrip dividend, what will be the total wealth of the shareholder?

Give your answer to the nearest whole $.

$ ? .

An investor in the company currently holds 1,000 shares.

The company plans to issue a scrip dividend of 1 new share for every 10 shares currently held.

After the scrip dividend, what will be the total wealth of the shareholder?

Give your answer to the nearest whole $.

$ ? .

Question 105

A company has in a 5% corporate bond in issue on which there are two loan covenants.

* Interest cover must not fall below 3 times

* Retained earnings for the year must not fall below $3.5 million

The Company has 200 million shares in issue.

The most recent dividend per share was $0.04.

The Company intends increasing dividends by 10% next year.

Financial projections for next year are as follows:

Advise the Board of Directors which of the following will be the status of compliance with the loan covenants next year?

* Interest cover must not fall below 3 times

* Retained earnings for the year must not fall below $3.5 million

The Company has 200 million shares in issue.

The most recent dividend per share was $0.04.

The Company intends increasing dividends by 10% next year.

Financial projections for next year are as follows:

Advise the Board of Directors which of the following will be the status of compliance with the loan covenants next year?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: