Question 111

Which THREE of the following non-financial objectives would be most appropriate for a listed company in the food retailing industry?

Question 112

An all equity financed company plans an issue of new ordinary shares to the general public to raise finance for a new project The following data applies:

* 10 million ordinary shares are currently in issue with a market value of S3 each share

* The new project will cost S2.88 million and is expected to give a positive NPV of S1 million

* The issue will be priced at a AaA discount to the current share price.

What gam or loss per share will accrue to the existing shareholders?

* 10 million ordinary shares are currently in issue with a market value of S3 each share

* The new project will cost S2.88 million and is expected to give a positive NPV of S1 million

* The issue will be priced at a AaA discount to the current share price.

What gam or loss per share will accrue to the existing shareholders?

Question 113

Which of the following best explains why the interest rate parity model is highly effective in practice?

Question 114

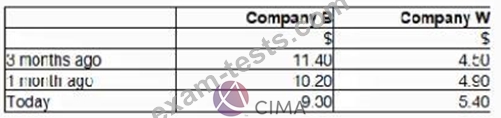

Company W has received an unwelcome takeover bid from Company B.

The offer is a share exchange of 3 shares in Company B for 5 shares in Company W or a cash alternative of $5.70 for each Company W share.

Company B is approximately twice the size of Company W based on market capitalisation. Although the two companies have some common business interested the main aim of the bid is diversification for Company B.

Company W has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

The following share price information is relevant.

Which of the following would be the most appropriate action by Company W's directors following receipt of this hostile bid?

The offer is a share exchange of 3 shares in Company B for 5 shares in Company W or a cash alternative of $5.70 for each Company W share.

Company B is approximately twice the size of Company W based on market capitalisation. Although the two companies have some common business interested the main aim of the bid is diversification for Company B.

Company W has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

The following share price information is relevant.

Which of the following would be the most appropriate action by Company W's directors following receipt of this hostile bid?

Question 115

A company's statement of financial position includes non-current assets which are leased, the tax regime follows the accounting treatment.

Which cash flows should be discounted when evaluating the cost of lease finance?

Which cash flows should be discounted when evaluating the cost of lease finance?