Question 121

Listed company R is in the process of making a cash offer for the equity of unlisted company S.

Company R has a market capitalisation of $200 million and a price/earnings ratio of 10.

Company S has a market capitalisation of $50 million and earnings of $7 million.

Company R intends to offer $60 million and expects to be able to realise synergistic benefits of $20 million by combining the two businesses. This estimate excludes the estimated $8 million cost of integrating the two businesses.

Which of the following figures need to be used when calculating the value of the combined entity in $ millions?

Company R has a market capitalisation of $200 million and a price/earnings ratio of 10.

Company S has a market capitalisation of $50 million and earnings of $7 million.

Company R intends to offer $60 million and expects to be able to realise synergistic benefits of $20 million by combining the two businesses. This estimate excludes the estimated $8 million cost of integrating the two businesses.

Which of the following figures need to be used when calculating the value of the combined entity in $ millions?

Question 122

A company is in the process of issuing a 10 year $100 million bond and is considering using an interest rate swap to change the interest profile on some or all of the $100 million new finance.

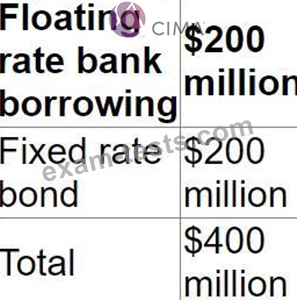

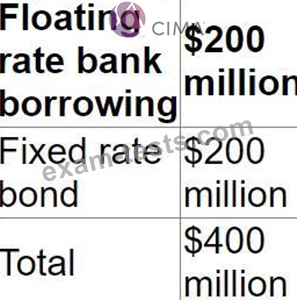

The company has a target fixed versus floating rate debt profile of 1:1. Before issuing the bond its debt profile was as follows:

Which of the following is the most appropriate interest rate swap structure for the company?

The company has a target fixed versus floating rate debt profile of 1:1. Before issuing the bond its debt profile was as follows:

Which of the following is the most appropriate interest rate swap structure for the company?

Question 123

Hospital X provides free healthcare to all members of the community, funded by the central Government.

Hospital Y provides healthcare which has to be paid for by the individual patients. It is a listed company, owned by a large number of shareholders.

In comparing the above two organisations and their objectives, which THREE of the following statements are correct?

Hospital Y provides healthcare which has to be paid for by the individual patients. It is a listed company, owned by a large number of shareholders.

In comparing the above two organisations and their objectives, which THREE of the following statements are correct?

Question 124

A new company was set up two years ago using the personal financial resources of the founders.

These funds were used to acquire suitable premises.

The company has entered into a long-term lease on the premises which are not yet fully fitted out.

The founders are considering requesting loan finance from the company's bank to fund the purchase of custom-made advanced technology equipment.

No other companies are using this type of equipment.

The company expects to continue to be profitable for the forseeable future.

It re-invests some of its surplus cash in on-going essential research and development.

Which THREE of the following features are likely to be considered negatives by the bank when assessing the company's credit-worthiness?

These funds were used to acquire suitable premises.

The company has entered into a long-term lease on the premises which are not yet fully fitted out.

The founders are considering requesting loan finance from the company's bank to fund the purchase of custom-made advanced technology equipment.

No other companies are using this type of equipment.

The company expects to continue to be profitable for the forseeable future.

It re-invests some of its surplus cash in on-going essential research and development.

Which THREE of the following features are likely to be considered negatives by the bank when assessing the company's credit-worthiness?

Question 125

A company gas a large cash balance but its directors have been unable to identify any positive NPV projects to invest in. Which THREE of the following are advantages of a share repurchase, compared with a one-off large dividend?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: