Question 86

A company is concerned that a high proportion of its debt portfolio consists of variable rate finance with an interest rate of LIBOR ' 1 .0%.

It is considering using an interest rate swap to reduce interest rate risk out is concerned about additional finance cost this might create.

A bank has quoted swap rates of 3% 3.5% against LIBOR.

A bank has quoted swap rates of 3% 3.5% against LIBOR.

Is an interest rate swap likely to be beneficial to the company at current LIBOR rates?

It is considering using an interest rate swap to reduce interest rate risk out is concerned about additional finance cost this might create.

A bank has quoted swap rates of 3% 3.5% against LIBOR.

A bank has quoted swap rates of 3% 3.5% against LIBOR.

Is an interest rate swap likely to be beneficial to the company at current LIBOR rates?

Question 87

Holding cash in excess of business requirements rather than returning the cash to shareholders is most likely to result in lower:

Question 88

An all equity financed company reported earnings for the year ending 31 December 20X1 of $8 million.

One of its financial objectives is to increase earnings by 5% each year.

In the year ending 31 December 20X2 it financed a project by issuing a bond with a $1 million nominal value and a coupon rate of 4%.

The company pays corporate income tax at 20%.

If the company is to achieve its earnings target for the year ending 31 December 20X2, what is the minimum operating profit (profit before interest and tax) that it must achieve?

One of its financial objectives is to increase earnings by 5% each year.

In the year ending 31 December 20X2 it financed a project by issuing a bond with a $1 million nominal value and a coupon rate of 4%.

The company pays corporate income tax at 20%.

If the company is to achieve its earnings target for the year ending 31 December 20X2, what is the minimum operating profit (profit before interest and tax) that it must achieve?

Question 89

A company's latest accounts show profit after tax of $20.0 million, after deducting interest of $5.0 million. The company expects earnings to grow at 5% per annum indefinitely.

The company has estimated its cost of equity at 12%, which is included in the company WACC of 10%.

Assuming that profit after tax is equivalent to cash flows, what is the value of the equity capital?

Give your answer to the nearest $ million.

$ ? million

The company has estimated its cost of equity at 12%, which is included in the company WACC of 10%.

Assuming that profit after tax is equivalent to cash flows, what is the value of the equity capital?

Give your answer to the nearest $ million.

$ ? million

Question 90

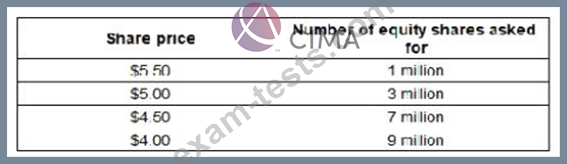

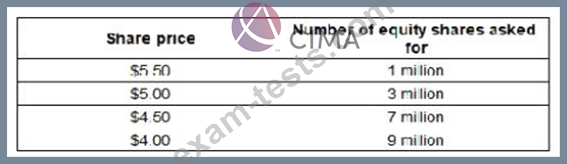

RST wishes to raise at least $40 million of new equity by issuing up to 10 million new equity shares at a minimum price of $3.00 under an offer for sale by tender. It receives the following tender offers:

What is the maximum amount that RST can raise by this share issue?

(Give your answer to the nearest $ million).

What is the maximum amount that RST can raise by this share issue?

(Give your answer to the nearest $ million).

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: