Question 66

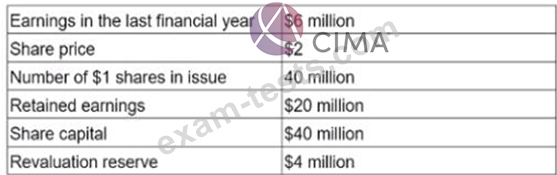

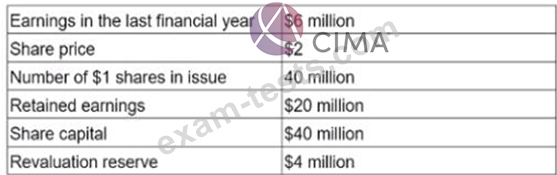

An unlisted company has the following data:

A listed company in the same industry has a P/E of 11.

The value of the unlisted company based on the P/E of this listed company is:

Give your answer to the nearest whole number.

A listed company in the same industry has a P/E of 11.

The value of the unlisted company based on the P/E of this listed company is:

Give your answer to the nearest whole number.

Question 67

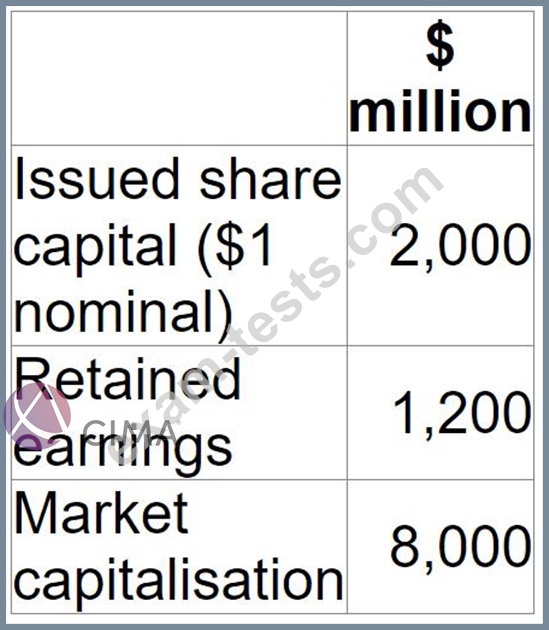

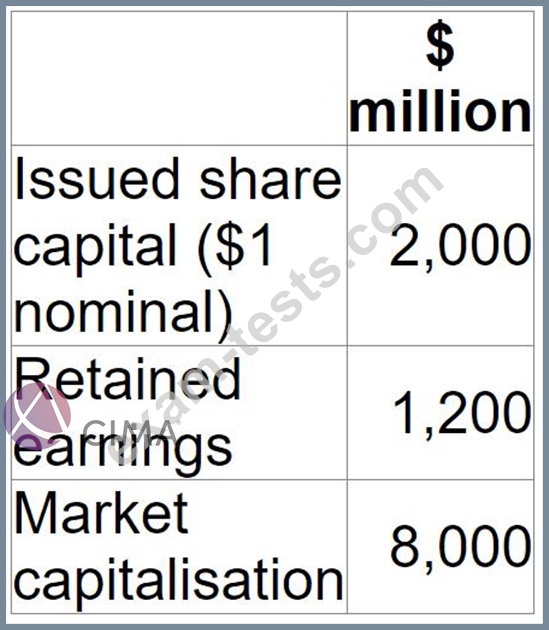

A listed company is financed by debt and equity.

If it increases the proportion of debt in its capital structure it would be in danger of breaching a debt covenant imposed by one of its lenders.

The following data is relevant:

The company now requires $800 million additional funding for a major expansion programme.

Which of the following is the most appropriate as a source of finance for this expansion programme?

If it increases the proportion of debt in its capital structure it would be in danger of breaching a debt covenant imposed by one of its lenders.

The following data is relevant:

The company now requires $800 million additional funding for a major expansion programme.

Which of the following is the most appropriate as a source of finance for this expansion programme?

Question 68

Company AEE has a 10 year 6% corporate bond in issue which has a nominal value of $400 million, which is currently trading at 95%. The bond is secured on the company's property

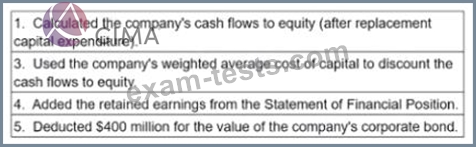

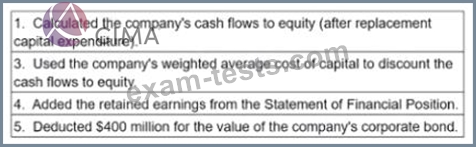

The Board of Directors has calculated the equity value of Company AEE as follows;

Which THREE of the following are errors in the valuation?

The Board of Directors has calculated the equity value of Company AEE as follows;

Which THREE of the following are errors in the valuation?

Question 69

A listed company plans to raise new capital which will be required for future investment projects. The company has a gearing ratio of 50%, which is just below the company's target ratio.

The directors are comparing the benefits and drawbacks of each of the following two alternative sources of finance;

* Unsecured bank borrowings.

* Convertible bonds.

Which of the following statements is correct?

The directors are comparing the benefits and drawbacks of each of the following two alternative sources of finance;

* Unsecured bank borrowings.

* Convertible bonds.

Which of the following statements is correct?

Question 70

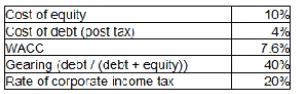

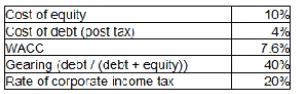

AA is considering changing its capital structure. The following information is currently relevant to AA:

The gearing rating raising the new debt finance will be 50%.

Which THREE of the following statement about the impact of AA's change in capital structure are true under Modigliani and Miler's capital structure theory with tax.

The gearing rating raising the new debt finance will be 50%.

Which THREE of the following statement about the impact of AA's change in capital structure are true under Modigliani and Miler's capital structure theory with tax.

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: