Question 76

A venture capitalist invests in a company by means of buying:

* 9 million shares for $2 a share and

* 8% bonds with a nominal value of $2 million, repayable at par in 3 years' time.

The venture capitalist expects a return on the equity portion of the investment of at least 20% a year on a compound basis over the first 3 years of the investment.

The company has 10 million shares in issue.

What is the minimum total equity value for the company in 3 years' time required to satisify the venture capitalist's expected return?

Give your answer to the nearest $ million.

$ million.

* 9 million shares for $2 a share and

* 8% bonds with a nominal value of $2 million, repayable at par in 3 years' time.

The venture capitalist expects a return on the equity portion of the investment of at least 20% a year on a compound basis over the first 3 years of the investment.

The company has 10 million shares in issue.

What is the minimum total equity value for the company in 3 years' time required to satisify the venture capitalist's expected return?

Give your answer to the nearest $ million.

$ million.

Question 77

A company's current profit before interest and taxation is $1.1 million and it is expected to remain constant for the foreseeable future.

The company has 4 million shares in issue on which the earnings yield is currently 10%. It also has a $2 million bond in issue with a fixed interest rate of 5%.

The corporate income tax rate is 20% and is expected to remain unchanged.

Which of the following is the best estimate of the current share price?

The company has 4 million shares in issue on which the earnings yield is currently 10%. It also has a $2 million bond in issue with a fixed interest rate of 5%.

The corporate income tax rate is 20% and is expected to remain unchanged.

Which of the following is the best estimate of the current share price?

Question 78

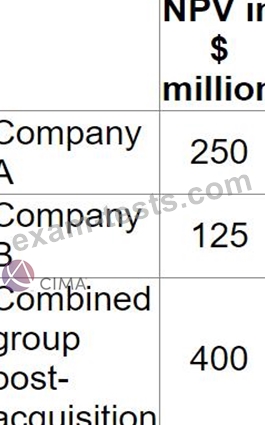

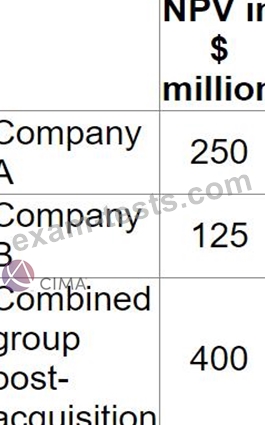

Company A is planning to acquire Company B by means of a cash offer. The directors of Company B are prepared to recommend acceptance if a bid price can be agreed. Estimates of the net present value (NPV) of future cash flows for the two companies and the combined group post acquisition have been prepared by Company A's accountant. There are as follows:

What is the maximum price that Company A should offer for the shares in Company B?

Give your answer to the nearest $ million

What is the maximum price that Company A should offer for the shares in Company B?

Give your answer to the nearest $ million

Question 79

The International Integrated Reporting Council (IIRC) was formed in August 2010 and brings together a cross-section of representatives from a wide variety of business sectors.

The primary purpose of the IIRC's framework is to help enable an organsation to communicate how it:

The primary purpose of the IIRC's framework is to help enable an organsation to communicate how it:

Question 80

Company AAB is located in country A whose currency is the AS It has a subsidiary, BBA, located m country B that has the BS as its currency AAB has asked BBA to pay BS40 million surplus funds to AAB to assist with a planned new capital investment in country A The exchange rate today is AS1 = BS3

Tax regimes

* Company BBA pays withholding tax of 25% on all cash remitted to the parent company

* Company AAB pays tax of 10% on at cash received from its subsidiary

How much will company AAB have available for investment after receiving the surplus funds from BBA?

Tax regimes

* Company BBA pays withholding tax of 25% on all cash remitted to the parent company

* Company AAB pays tax of 10% on at cash received from its subsidiary

How much will company AAB have available for investment after receiving the surplus funds from BBA?