Question 46

A company plans to cut its dividend but is concerned that the share price will fall. This demonstrates the _____________ effect

Question 47

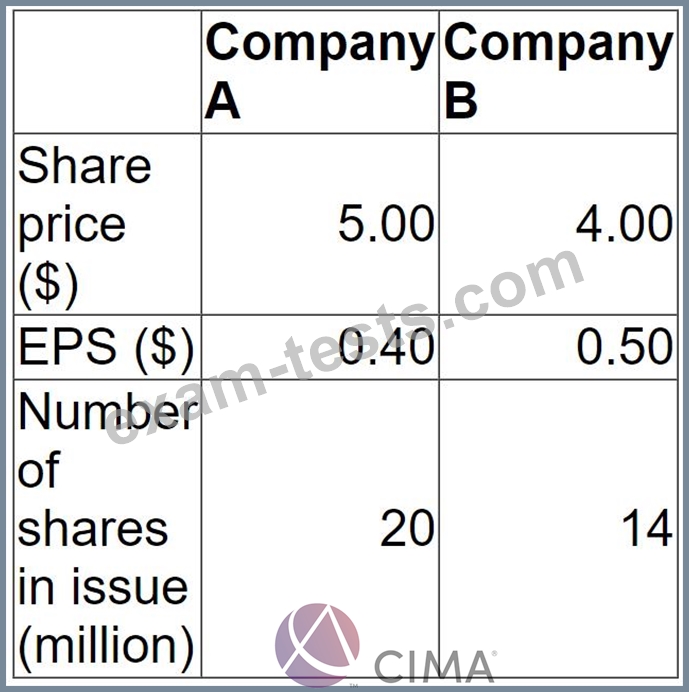

Company A is planning to acquire Company B at a price of $ 65 million by means of a cash bid.

Company A is confident that the merged entity can achieve the same price earnings ratio as that of Company A.

What does Company A expect the value of the merged entity to be post acquisition?

Company A is confident that the merged entity can achieve the same price earnings ratio as that of Company A.

What does Company A expect the value of the merged entity to be post acquisition?

Question 48

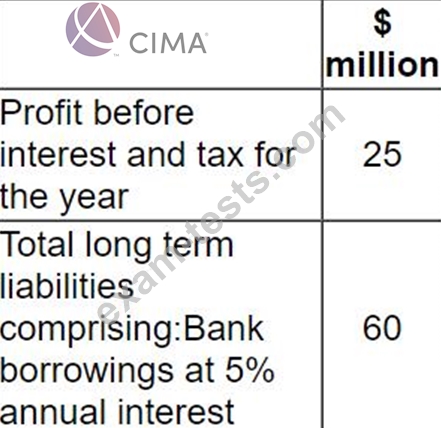

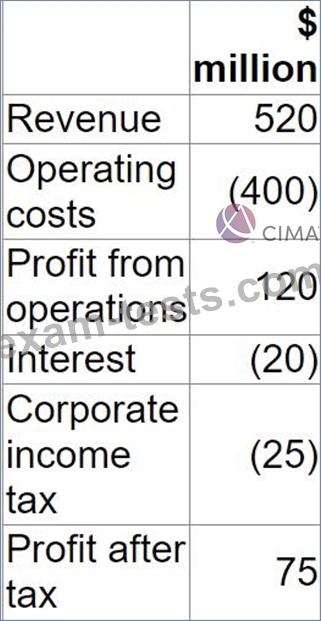

At the last financial year end, 31 December 20X1, a company reported:

The corporate income tax rate is 30% and the bank borrowings are subject to an interest cover covenant of 4 times.

The results are presently comfortably within the interest cover covenant as they show interest cover of 8.3 times. The company plans to invest in a new product line which is not expected to affect profit in the first year but will require additional borrowings of $20 million at an annual interest rate of 10%.

What is the likely impact on the existing interest cover covenant?

The corporate income tax rate is 30% and the bank borrowings are subject to an interest cover covenant of 4 times.

The results are presently comfortably within the interest cover covenant as they show interest cover of 8.3 times. The company plans to invest in a new product line which is not expected to affect profit in the first year but will require additional borrowings of $20 million at an annual interest rate of 10%.

What is the likely impact on the existing interest cover covenant?

Question 49

Company Z has identified four potential acquisition targets: companies A, B, C and D.

Company Z has a current equity market value of $580 million.

The price it would have to pay for the equity of each company is as follows:

Only one of the target companies can be acquired and the consideration will be paid in cash.

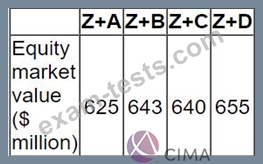

The following estimations of the new combined value of Company Z have been prepared for each acquisition before deduction of the cash consideration:

Ignoring any premium paid on acquisition, which acquisition should the directors pursue?

Company Z has a current equity market value of $580 million.

The price it would have to pay for the equity of each company is as follows:

Only one of the target companies can be acquired and the consideration will be paid in cash.

The following estimations of the new combined value of Company Z have been prepared for each acquisition before deduction of the cash consideration:

Ignoring any premium paid on acquisition, which acquisition should the directors pursue?

Question 50

The table below shows the forecast for a company's next financial year:

The forecast incorporates the following assumptions:

* 25% of operating costs are variable

* Debt finance comprises a $400 million fixed rate loan at 5%

* Corporate income tax is paid at 25%

The company plans to do the following next year from the forecast earnings on the assumption that earnings will be equivalent to free cash flow:

* Pay a total dividend of $20 million

* Invest $40 million in new projects

What is the maximum % reduction in operating activity that could occur next year before the company's dividend and investment plans are affected?

Give your answer to the nearest 0.1%.

The forecast incorporates the following assumptions:

* 25% of operating costs are variable

* Debt finance comprises a $400 million fixed rate loan at 5%

* Corporate income tax is paid at 25%

The company plans to do the following next year from the forecast earnings on the assumption that earnings will be equivalent to free cash flow:

* Pay a total dividend of $20 million

* Invest $40 million in new projects

What is the maximum % reduction in operating activity that could occur next year before the company's dividend and investment plans are affected?

Give your answer to the nearest 0.1%.