Question 76

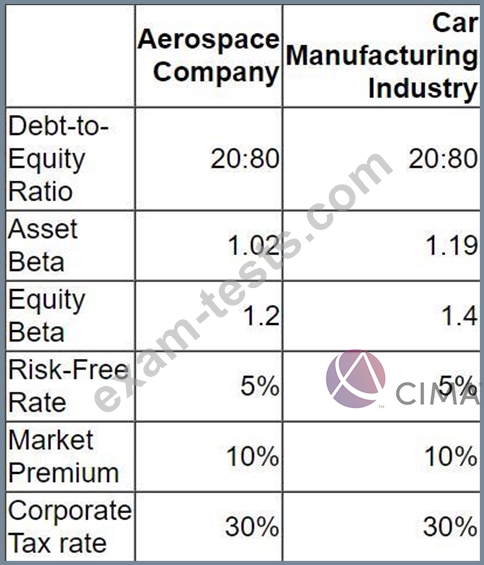

An aerospace company is planning to diversify into car manufacturing.

Relevant data:

What is the the cost of equity to be used in the WACC for the project appraisal?

Give your answer in percentage, as a whole number.

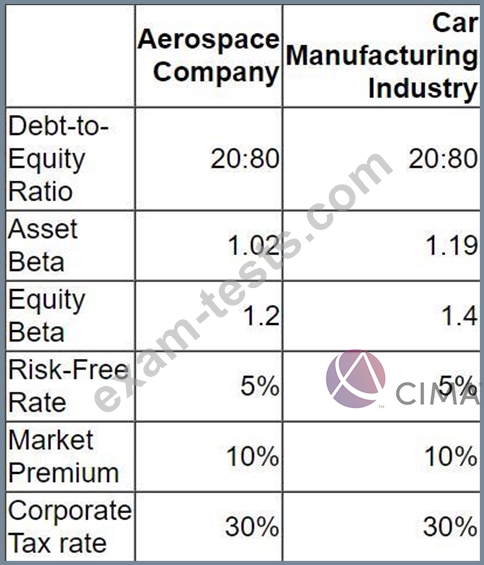

Relevant data:

What is the the cost of equity to be used in the WACC for the project appraisal?

Give your answer in percentage, as a whole number.

Question 77

A company's gearing (measured as debt/(debt + equity)) is currently 60% and it is investigating whether an optimal gearing structure exists within the industry.

It has analysed the capital structure of similar companies in the industry and it would appear that there is evidence supporting the traditional theory of capital structure.

Companies with the lowest WACC in the industry have gearing of around 45% to 50%.

Which of the following actions would result in the company achieving a more optimal capital structure?

It has analysed the capital structure of similar companies in the industry and it would appear that there is evidence supporting the traditional theory of capital structure.

Companies with the lowest WACC in the industry have gearing of around 45% to 50%.

Which of the following actions would result in the company achieving a more optimal capital structure?

Question 78

A company is considering either exporting its product directly to customers in a foreign country or establishing a manufacturing subsidiary in that country.

The corporate tax rate in the company's own country is 20% and 25% tax depreciation allowances are available.

Which THREE of the following would be considered advantages of establishing the subsidiary in the foreign country?

The corporate tax rate in the company's own country is 20% and 25% tax depreciation allowances are available.

Which THREE of the following would be considered advantages of establishing the subsidiary in the foreign country?

Question 79

Company H is considering the valuation of an unlisted company which it hopes to acquire.

It has obtained the target company's financial statements.

Company H has been advised that the book value of net assets as shown in the financial statements of the target company does not provide a reliable indicator of their true value.

Advise the Board of Directors which of the following THREE statements are disadvantages of the net asset basis of valuation?

It has obtained the target company's financial statements.

Company H has been advised that the book value of net assets as shown in the financial statements of the target company does not provide a reliable indicator of their true value.

Advise the Board of Directors which of the following THREE statements are disadvantages of the net asset basis of valuation?

Question 80

A major energy company, GDE, generates and distributes electricity in country A.

The government of country A is concerned about rising inflation and has imposed price controls on GDE, limiting the price it can charge per unit of electricity sold to both domestic and commercial customers. It is likely that price controls will continue for the foreseeable future.

The introduction of price controls is likely to reduce the profit for the current year from $3 billion to $1 billion.

The company has:

* Distributable reserves of $2 billion.

* Surplus cash at the start of the year of $1 billion.

* Plans to pay a total dividend of $1.5 billion in respect of the current year, representing a small annual increase as in previous years. However, no dividends have yet been announced.

Which THREE of the following responses would be MOST appropriate for GDE following the imposition of price controls?

The government of country A is concerned about rising inflation and has imposed price controls on GDE, limiting the price it can charge per unit of electricity sold to both domestic and commercial customers. It is likely that price controls will continue for the foreseeable future.

The introduction of price controls is likely to reduce the profit for the current year from $3 billion to $1 billion.

The company has:

* Distributable reserves of $2 billion.

* Surplus cash at the start of the year of $1 billion.

* Plans to pay a total dividend of $1.5 billion in respect of the current year, representing a small annual increase as in previous years. However, no dividends have yet been announced.

Which THREE of the following responses would be MOST appropriate for GDE following the imposition of price controls?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: