Question 91

A company has 8% convertible bonds in issue. The bonds are convertible in 3 years time at a ratio of 20 ordinary shares per $100 nominal value bond.

Each share:

* has a current market value of $5.60

* is expected to grow at 5% each year

What is the expected conversion value of each $100 nominal value bond in 3 years' time?

Each share:

* has a current market value of $5.60

* is expected to grow at 5% each year

What is the expected conversion value of each $100 nominal value bond in 3 years' time?

Question 92

X exports goods to customers in a number of small countries Asia. At present, X invoices customers in X's home currency.

The Sales Director has proposed that X should begin to invoice in the customers currency, and the Treasurers considering the implications of the proposal.

Which TWO of the following statement are correct?

The Sales Director has proposed that X should begin to invoice in the customers currency, and the Treasurers considering the implications of the proposal.

Which TWO of the following statement are correct?

Question 93

A company is planning to issue a 5 year $100 million bond at a fixed rate of 6%.

It is also considering whether or not to enter into a 10 year $100 million swap to receive 5% fixed and pay Libor + 1% once a year.

The company predicts that Libor will be 4% over the life of the 5 years.

What is the impact of the swap on the company's annual interest cost assuming that the Libor prediction is correct?

It is also considering whether or not to enter into a 10 year $100 million swap to receive 5% fixed and pay Libor + 1% once a year.

The company predicts that Libor will be 4% over the life of the 5 years.

What is the impact of the swap on the company's annual interest cost assuming that the Libor prediction is correct?

Question 94

Company A has made an offer to acquire Company Z.

Both companies are quoted and their current market share prices are:

* Company A - $4

* Company Z - $5

Shareholders in company Z have been given three alternative offers:

* Cash of $5.50 per share

* Share for share exchange on the basis of 3 for 2

* 10.5% long dated bond for every 20 shares

The bond is has a nominal value of $100 and the expected yield on bonds of similar risk is 10%.

You are advising a Company Z shareholder on the three offers.

She requires a 15% premium if she is to accept the offer.

In providing your advice, which of the following statements is correct?

Both companies are quoted and their current market share prices are:

* Company A - $4

* Company Z - $5

Shareholders in company Z have been given three alternative offers:

* Cash of $5.50 per share

* Share for share exchange on the basis of 3 for 2

* 10.5% long dated bond for every 20 shares

The bond is has a nominal value of $100 and the expected yield on bonds of similar risk is 10%.

You are advising a Company Z shareholder on the three offers.

She requires a 15% premium if she is to accept the offer.

In providing your advice, which of the following statements is correct?

Question 95

Listed Company A has prepared a valuation of an unlisted company. Company B.

to achieve vertical integration Company A is intending to acquire a controlling interest in the equity of Company B and therefore wants to value only the equity of Company B.

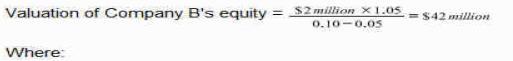

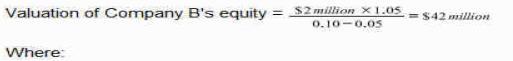

The assistant accountant of Company A has prepared the following valuation of Company B's equity using the dividend valuation model (DVM):

Where:

* S2 million is Company B's most recent dividend

* 5% is Company B's average dividend growth rate over the last 5 years

* 10% is a cost of equity calculated using the capital asset pricing model (CAPM), based on the industry average beta factor

Which THREE of the following are valid criticisms of the valuation of Company B's equity prepared by the assistant accountant?

to achieve vertical integration Company A is intending to acquire a controlling interest in the equity of Company B and therefore wants to value only the equity of Company B.

The assistant accountant of Company A has prepared the following valuation of Company B's equity using the dividend valuation model (DVM):

Where:

* S2 million is Company B's most recent dividend

* 5% is Company B's average dividend growth rate over the last 5 years

* 10% is a cost of equity calculated using the capital asset pricing model (CAPM), based on the industry average beta factor

Which THREE of the following are valid criticisms of the valuation of Company B's equity prepared by the assistant accountant?