Question 101

Under traditional theory, an increase in a company's WACC would cause the value of the company to:

Question 102

A company has a covenant on its 5% long-term bond, stipulating that its retained earnings must not fall below

$2 million.

The company has 100 million shares in issue.

Its most recent dividend was $0.045 per share. It has committed to grow the dividend per share by 4% each year.

The nominal value of the bond is $60 million. It is currently trading at 80% of its nominal value.

Next year's earnings before interest and taxation are projected to be $11.25 million.

The rate of corporate tax is 20%.

If the company increases the dividend by 4%, advise the Board of Directors if the level of retained earnings will comply with the covenant?

$2 million.

The company has 100 million shares in issue.

Its most recent dividend was $0.045 per share. It has committed to grow the dividend per share by 4% each year.

The nominal value of the bond is $60 million. It is currently trading at 80% of its nominal value.

Next year's earnings before interest and taxation are projected to be $11.25 million.

The rate of corporate tax is 20%.

If the company increases the dividend by 4%, advise the Board of Directors if the level of retained earnings will comply with the covenant?

Question 103

A project requires an initial outlay of $2 million which can be financed with either a bank loan or finance lease.

The company will be responsible for annual maintenance under either option.

The tax regime is:

* Tax depreciation allowances can be claimed on purchased assets.

* If leased using a finance lease, tax relief can be claimed on the interest element of the lease payments and also on the accounting depreciation charge.

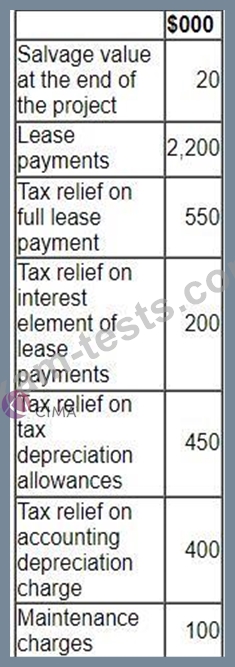

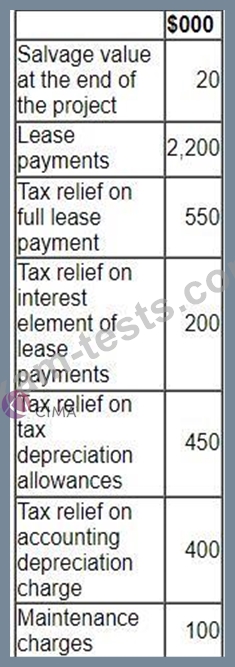

The trainee management accountant has begun evaluating the lease versus buy decision and has produced the following data. He is not confident that all this information is relevant to this decision.

Using only the relevant data, which of the following is correct?

The company will be responsible for annual maintenance under either option.

The tax regime is:

* Tax depreciation allowances can be claimed on purchased assets.

* If leased using a finance lease, tax relief can be claimed on the interest element of the lease payments and also on the accounting depreciation charge.

The trainee management accountant has begun evaluating the lease versus buy decision and has produced the following data. He is not confident that all this information is relevant to this decision.

Using only the relevant data, which of the following is correct?

Question 104

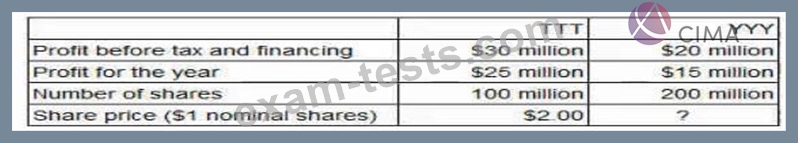

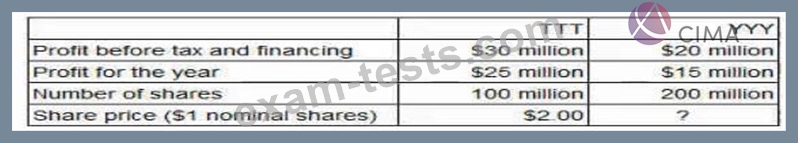

Two unlisted companies TTT and YYY are being valued. The companies have similar capital structures and risk profiles and operate in the same industry sector It is easier to value TTT than to value YYY because there have recently been several well-publicised private sales of TTT shares.

Relevant company data:

What is the best estimate of YYY's share price?

Relevant company data:

What is the best estimate of YYY's share price?

Question 105

A national airline has made an offer to acquire a smaller airline in the same country.

Which of the following would be of most concern to the competition authorities?

Which of the following would be of most concern to the competition authorities?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: