Question 81

A listed publishing company owns a subsidiary company whose business activity is training.

It wishes to dispose of the subsidiary company.

The following information is available:

The board of the publishing company believe that the value of the subsidiary company, and hence the value of the equity invested in it, can be determined by calculating the present value of the subsidiary's free cashflows.

Which of the following is the most appropriate discount rate to use when determining the enterprise value of the company?

It wishes to dispose of the subsidiary company.

The following information is available:

The board of the publishing company believe that the value of the subsidiary company, and hence the value of the equity invested in it, can be determined by calculating the present value of the subsidiary's free cashflows.

Which of the following is the most appropriate discount rate to use when determining the enterprise value of the company?

Question 82

The value of a call option will increase because of:

Question 83

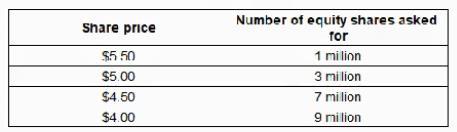

RST wishes to raise at least $40 million of new equity by issuing up to 10 million new equity shares at a minimum price of $3.00 under an offer for sale by tender. It receives the following tender offers:

What is the maximum amount that RST can raise by this share issue?

(Give your answer to the nearest $ million).

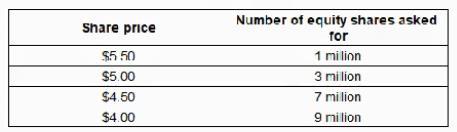

What is the maximum amount that RST can raise by this share issue?

(Give your answer to the nearest $ million).

Question 84

A listed company plans to raise $350 million to finance a major expansion programme.

The cash flow projections for the programme are subject to considerable variability.

Brief details of the programme have been public knowledge for a few weeks.

The directors are considering two financing options, either a rights issue at a 20% discount to current share price or a long term bond.

The following data is relevant:

The company's share price has fallen by 5% over the past 3 months compared with a fall in the market of

3% over the same period.

The directors favour the bond option.

However, the Chief Accountant has provided arguments for a rights issue.

Which TWO of the following arguments in favour of a right issue are correct?

The cash flow projections for the programme are subject to considerable variability.

Brief details of the programme have been public knowledge for a few weeks.

The directors are considering two financing options, either a rights issue at a 20% discount to current share price or a long term bond.

The following data is relevant:

The company's share price has fallen by 5% over the past 3 months compared with a fall in the market of

3% over the same period.

The directors favour the bond option.

However, the Chief Accountant has provided arguments for a rights issue.

Which TWO of the following arguments in favour of a right issue are correct?

Question 85

Company A is planning to acquire Company B.

Both companies are listed and are of similar size based on market capitalisation No approach has yet been made to Company B's shareholders as the directors of Company A are undecided about the most suitable method of financing the offer Two methods are under consideration a share exchange or a cash offer financed by debt.

Company A currently has a gearing ratio (debt to debt plus equity) of 30% based on market values. The average gearing ratio (debt to debt plus equity) for the industry is 50% Although no formal offer has been made there have been market rumours of the proposed bid. which is seen as favorable to Company A.

As a consequence. Company As share price has risen over the past few weeks while Company B's share price has fallen.

Which THREE of the following statements are most likely to be correct?

Both companies are listed and are of similar size based on market capitalisation No approach has yet been made to Company B's shareholders as the directors of Company A are undecided about the most suitable method of financing the offer Two methods are under consideration a share exchange or a cash offer financed by debt.

Company A currently has a gearing ratio (debt to debt plus equity) of 30% based on market values. The average gearing ratio (debt to debt plus equity) for the industry is 50% Although no formal offer has been made there have been market rumours of the proposed bid. which is seen as favorable to Company A.

As a consequence. Company As share price has risen over the past few weeks while Company B's share price has fallen.

Which THREE of the following statements are most likely to be correct?