Question 76

Which THREE of the following remain unchanged over the life of a 10 year fixed rate bond?

Question 77

Modigliani and Miller are the main proponents of the view that the dividend policy is irrelevant to the value of a company's shares.

They argue that a company that continually reinvests its entire earnings would generate the same shareholder wealth if it engaged in a policy of high dividends and financed its expansion with funds obtained from rights issues.

Which THREE of the following statements are assumptions that are required in order to support this proposition?

They argue that a company that continually reinvests its entire earnings would generate the same shareholder wealth if it engaged in a policy of high dividends and financed its expansion with funds obtained from rights issues.

Which THREE of the following statements are assumptions that are required in order to support this proposition?

Question 78

A company's annual dividend has grown steadily at an annual rate of 3% for many years. It has a cost of equity of 11%. The share price is presently $64.38.

The company is about to announce its latest dividend, which is expected to be $5.00 per share.

The Board of Directors is considering an attractive investment opportunity that would have to be funded by reducing the dividend to $4.50 per share. The board expects the project to enable future dividends to grow by

5% every year and the cost of equity to remain unchanged.

Calculate the change in share price, assuming that the directors announce their intention to proceed with this investment opportunity.

Give your answer to 2 decimal places.

The company is about to announce its latest dividend, which is expected to be $5.00 per share.

The Board of Directors is considering an attractive investment opportunity that would have to be funded by reducing the dividend to $4.50 per share. The board expects the project to enable future dividends to grow by

5% every year and the cost of equity to remain unchanged.

Calculate the change in share price, assuming that the directors announce their intention to proceed with this investment opportunity.

Give your answer to 2 decimal places.

Question 79

Company Z has just completed the all-cash acquisition of Company A.

Both companies operate in the advertising industry.

The market considered the acquisition a positive strategic move by Company Z.

Which THREE of the following will the shareholders of Company Z expect the company's directors to prioritise following the acquisition?

Both companies operate in the advertising industry.

The market considered the acquisition a positive strategic move by Company Z.

Which THREE of the following will the shareholders of Company Z expect the company's directors to prioritise following the acquisition?

Question 80

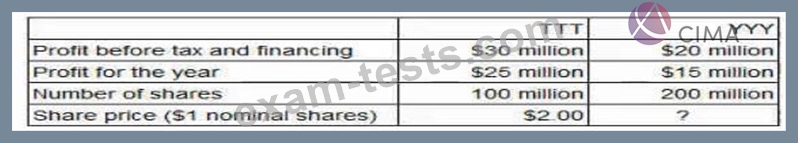

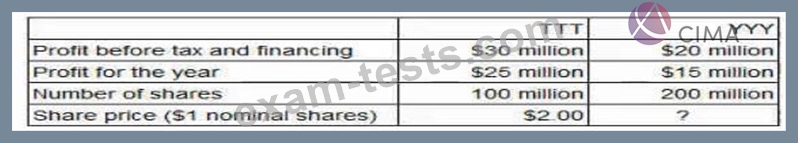

Two unlisted companies TTT and YYY are being valued. The companies have similar capital structures and risk profiles and operate in the same industry sector It is easier to value TTT than to value YYY because there have recently been several well-publicised private sales of TTT shares.

Relevant company data:

What is the best estimate of YYY's share price?

Relevant company data:

What is the best estimate of YYY's share price?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: