Question 81

A venture capitalist has made an equity investment in a private company and is evaluating possible methods by which it can exit the investment over the next 3 years. The private company shareholders comprise the four original founders and the venture capitalist.

Advise the venture capitalist which THREE of the following methods will enable it to exit its equity investment?

Advise the venture capitalist which THREE of the following methods will enable it to exit its equity investment?

Question 82

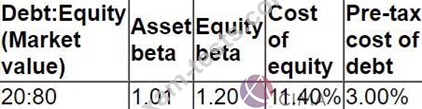

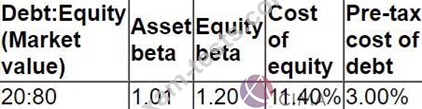

The following information relates to Company A's current capital structure:

Company A is considering a change in the capital structure that will increase gearing to 30:70 (Debt:Equity).

The risk -free rate is 3% and the return on the market portfolio is expected to be 10%.

The rate of corporate tax is 25%

Using the Capital Asset Pricing Model, calculate the cost of equity resulting from the proposed change to the capital structure.

Company A is considering a change in the capital structure that will increase gearing to 30:70 (Debt:Equity).

The risk -free rate is 3% and the return on the market portfolio is expected to be 10%.

The rate of corporate tax is 25%

Using the Capital Asset Pricing Model, calculate the cost of equity resulting from the proposed change to the capital structure.

Question 83

A company has identified potential profitable investments that would require a total of S50 million capital expenditure over the next two years The following information is relevant.

* The company has 100 million shares in issue and has a market capitalisation of S500 million

* It has a target debt to equity ratio of 40% based on market values This ratio is currently 30%

* Earnings for the current year are expected to be S1 00 million

* Its last dividend payment was $1 per share One of the company's objectives is to increase dividends by at least 10% each year

* The company has no cash reserves

Which of the following is the most suitable method of financing to meet the company's requirements?

* The company has 100 million shares in issue and has a market capitalisation of S500 million

* It has a target debt to equity ratio of 40% based on market values This ratio is currently 30%

* Earnings for the current year are expected to be S1 00 million

* Its last dividend payment was $1 per share One of the company's objectives is to increase dividends by at least 10% each year

* The company has no cash reserves

Which of the following is the most suitable method of financing to meet the company's requirements?

Question 84

Company A is unlisted and all-equity financed. It is trying to estimate its cost of equity.

The following information relates to another company, Company B, which operates in the same industry as Company A and has similar business risk:

Equity beta = 1.6

Debt:equity ratio 40:60

The rate of corporate income tax is 20%.

The expected premium on the market portfolio is 7% and the risk-free rate is 5%.

What is the estimated cost of equity for Company A?

Give your answer to one decimal place.

The following information relates to another company, Company B, which operates in the same industry as Company A and has similar business risk:

Equity beta = 1.6

Debt:equity ratio 40:60

The rate of corporate income tax is 20%.

The expected premium on the market portfolio is 7% and the risk-free rate is 5%.

What is the estimated cost of equity for Company A?

Give your answer to one decimal place.

Question 85

A company has announced a rights issue of 1 new share for every 4 existing shares.

Relevant data:

* The current market price per share is $10.00.

* Rights are to be issued at a 20% discount to the current price.

* The rate of return on the new funds raised is expected to be 10%.

* The rate of return on existing funds is 5%.

What is the yield-adjusted theoretical ex-rights price?

Give your answer to two decimal places.

$ ?

Relevant data:

* The current market price per share is $10.00.

* Rights are to be issued at a 20% discount to the current price.

* The rate of return on the new funds raised is expected to be 10%.

* The rate of return on existing funds is 5%.

What is the yield-adjusted theoretical ex-rights price?

Give your answer to two decimal places.

$ ?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: