Question 86

A company plans to raise $12 million to finance an expansion project using a rights issue.

Relevant data:

* Shares will be offered at a 20% discount to the present market price of $15.00 per share.

* There are currently 2 million shares in issue.

* The project is forecast to yield a positive NPV of $6 million.

What is the yield-adjusted Theoretical Ex-Rights Price following the announcement of the rights issue?

Relevant data:

* Shares will be offered at a 20% discount to the present market price of $15.00 per share.

* There are currently 2 million shares in issue.

* The project is forecast to yield a positive NPV of $6 million.

What is the yield-adjusted Theoretical Ex-Rights Price following the announcement of the rights issue?

Question 87

On 1 January 20X1, a company had:

* Cost of equity of 10 0%.

* Cost of debt of 5.0%

* Debt of $100Mmilion

* 100 million $1 shares trading at $4.00 each.

On 1 February 20X1:

* The company's share police fell to $3.00.

* Debt and the cost of debt remained unchanged

The company does not pay tax.

Under Modigliani and Miller's theory without lax. what is the best estimate of the movement in the cost of equity as a result of the fall in ne share price?

* Cost of equity of 10 0%.

* Cost of debt of 5.0%

* Debt of $100Mmilion

* 100 million $1 shares trading at $4.00 each.

On 1 February 20X1:

* The company's share police fell to $3.00.

* Debt and the cost of debt remained unchanged

The company does not pay tax.

Under Modigliani and Miller's theory without lax. what is the best estimate of the movement in the cost of equity as a result of the fall in ne share price?

Question 88

The primary objective of a public sector entity is to ensure value for money is generated.

Value for money is defined as performing an activity so as to simultaneously achieve economy, efficiency and effectiveness Efficiency is defined as:

Value for money is defined as performing an activity so as to simultaneously achieve economy, efficiency and effectiveness Efficiency is defined as:

Question 89

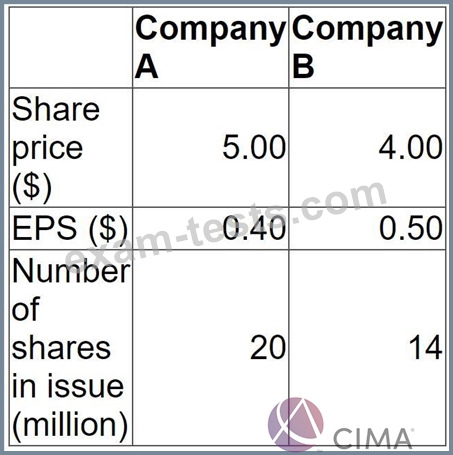

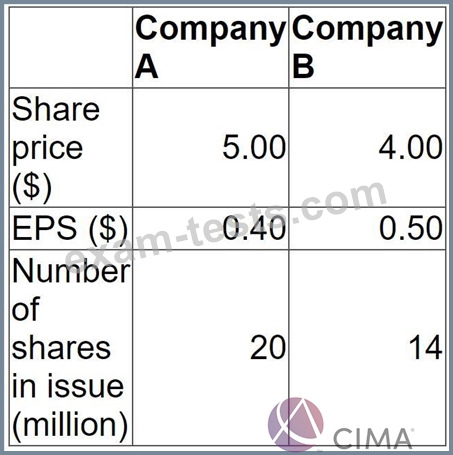

Company A is planning to acquire Company B at a price of $ 65 million by means of a cash bid.

Company A is confident that the merged entity can achieve the same price earnings ratio as that of Company A.

What does Company A expect the value of the merged entity to be post acquisition?

Company A is confident that the merged entity can achieve the same price earnings ratio as that of Company A.

What does Company A expect the value of the merged entity to be post acquisition?

Question 90

Company A is a large well-established listed entertainment company and Company B is a small unlisted company specializing in providing online media streaming.

Company A has a gearing ratio of 60% (using book values) and interest cover of 2.

Company A is considering making an offer for Company B, either a cash offer financial by raising additional debt finance or a share-for-share exchange.

Which of the following is most likely to occur if Company A offers a share-for exchange rather than offering cash finance by raising debt?

Company A has a gearing ratio of 60% (using book values) and interest cover of 2.

Company A is considering making an offer for Company B, either a cash offer financial by raising additional debt finance or a share-for-share exchange.

Which of the following is most likely to occur if Company A offers a share-for exchange rather than offering cash finance by raising debt?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: