Question 96

A company plans a four-year project which will be financed by either an operating lease or a bank loan.

Lease details:

* Four year lease contract.

* Annual lease rentals of $45,000, paid in advance on the 1st day of the year.

Other information:

* The interest rate payable on the bank borrowing is 10%.

* The capital cost of the project is $200,000 which would have to be paid at the beginning of the first year.

* A salvage or residual value of $100,000 is estimated at the end of the project's life.

* Purchased assets attract straight line tax depreciation allowances.

* Corporate income tax is 20% and is payable at the end of the year following the year to which it relates.

A lease-or-buy appraisal is shown below:

Which THREE of the following items are errors within the appraisal?

Lease details:

* Four year lease contract.

* Annual lease rentals of $45,000, paid in advance on the 1st day of the year.

Other information:

* The interest rate payable on the bank borrowing is 10%.

* The capital cost of the project is $200,000 which would have to be paid at the beginning of the first year.

* A salvage or residual value of $100,000 is estimated at the end of the project's life.

* Purchased assets attract straight line tax depreciation allowances.

* Corporate income tax is 20% and is payable at the end of the year following the year to which it relates.

A lease-or-buy appraisal is shown below:

Which THREE of the following items are errors within the appraisal?

Question 97

Company A is identical in all operating and risk characteristics to Company B, but their capital structures differ.

Company B is all-equity financed. Its cost of equity is 17%.

Company A has a gearing ratio (debt:equity) of 1:2. Its pre-tax cost of debt is 7%.

Company A and Company B both pay corporate income tax at 30%.

What is the cost of equity for Company A?

Company B is all-equity financed. Its cost of equity is 17%.

Company A has a gearing ratio (debt:equity) of 1:2. Its pre-tax cost of debt is 7%.

Company A and Company B both pay corporate income tax at 30%.

What is the cost of equity for Company A?

Question 98

The ex div share price of a company's shares is $2.20.

An investor in the company currently holds 1,000 shares.

The company plans to issue a scrip dividend of 1 new share for every 10 shares currently held.

After the scrip dividend, what will be the total wealth of the shareholder?

Give your answer to the nearest whole $.

$ ? .

An investor in the company currently holds 1,000 shares.

The company plans to issue a scrip dividend of 1 new share for every 10 shares currently held.

After the scrip dividend, what will be the total wealth of the shareholder?

Give your answer to the nearest whole $.

$ ? .

Question 99

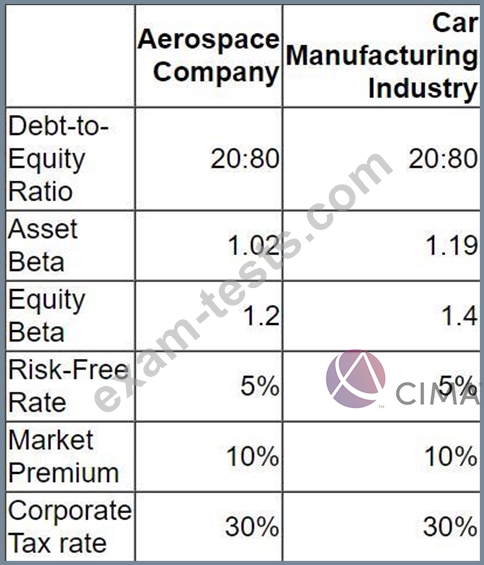

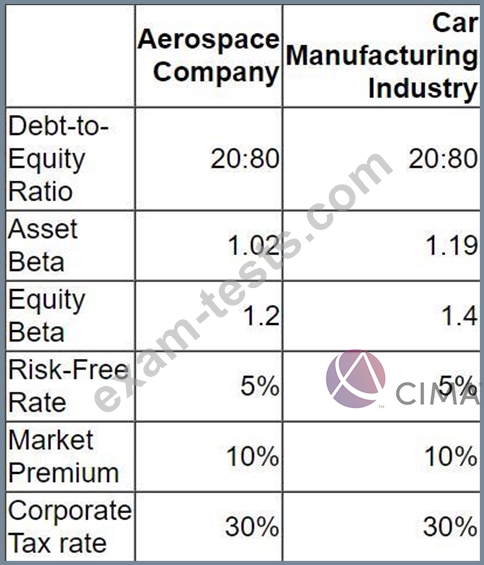

An aerospace company is planning to diversify into car manufacturing.

Relevant data:

What is the the cost of equity to be used in the WACC for the project appraisal?

Give your answer in percentage, as a whole number.

Relevant data:

What is the the cost of equity to be used in the WACC for the project appraisal?

Give your answer in percentage, as a whole number.

Question 100

The Board of Directors of a listed company is considering the company's dividend/retentions policy.

The inflation rate in the economy is currently high and is expected to remain so for the foreseeable future.

The board are unsure what impact the high level of inflation might have on the dividend policy.

Which THREE of the following statements are true?

The inflation rate in the economy is currently high and is expected to remain so for the foreseeable future.

The board are unsure what impact the high level of inflation might have on the dividend policy.

Which THREE of the following statements are true?