Question 101

Company B is an all equity financed company with a cost of equity of 10%.

It is considering issuing bonds in order to achieve a gearing level of 20% debt and 80% equity.

These bonds will pay a coupon rate of 5% and have an interest yield of 6%.

Company B pays corporate tax at the rate of 25%.

According to Modigliani and Miller's theory of capital structure with tax, what will be Company B's new cost of equity?

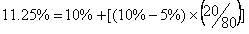

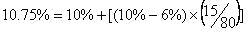

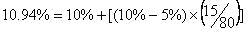

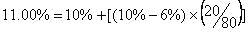

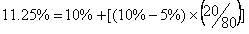

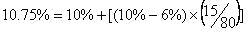

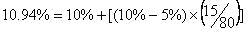

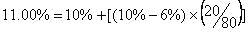

A)

B)

C)

D)

It is considering issuing bonds in order to achieve a gearing level of 20% debt and 80% equity.

These bonds will pay a coupon rate of 5% and have an interest yield of 6%.

Company B pays corporate tax at the rate of 25%.

According to Modigliani and Miller's theory of capital structure with tax, what will be Company B's new cost of equity?

A)

B)

C)

D)

Question 102

A company based in Country D, whose currency is the D$, has an objective of maintaining an operating profit margin of at least 10% each year.

Relevant data:

* The company makes sales to Country E whose currency is the E$. It also makes sales to Country F whose currency is the F$.

* All purchases are from Country G whose currency is the G$.

* The settlement of all transactions is in the currency of the customer or supplier.

Which of the following changes would be most likely to help the company achieve its objective?

Relevant data:

* The company makes sales to Country E whose currency is the E$. It also makes sales to Country F whose currency is the F$.

* All purchases are from Country G whose currency is the G$.

* The settlement of all transactions is in the currency of the customer or supplier.

Which of the following changes would be most likely to help the company achieve its objective?

Question 103

Which THREE of the following long term changes are most likely to increase the credit rating of a company?

Question 104

A company wishes to raise new finance using a rights issue. The following data applies:

* There are 10 million shares in issue with a market value of $4 each

* The terms of the rights will be 1 new share for 4 existing shares held

* After the rights issue, the theoretical ex-rights price (TERP) will be $3.80 Assuming all shareholders take up their rights, how much new finance will be raised ?

Give your answer to one decimal place.

* There are 10 million shares in issue with a market value of $4 each

* The terms of the rights will be 1 new share for 4 existing shares held

* After the rights issue, the theoretical ex-rights price (TERP) will be $3.80 Assuming all shareholders take up their rights, how much new finance will be raised ?

Give your answer to one decimal place.

Question 105

A company s about to announce a new project that has a positive NPV.

If the market is semi-strong form efficient, which of the following statements is most Likely to be true?

The value of the company will.

If the market is semi-strong form efficient, which of the following statements is most Likely to be true?

The value of the company will.

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: