Question 1

On 31 October 20X3:

* A company expected to agree a foreign currency transaction in January 20X4 for settlement on 31 March 20X4.

* The company hedged the currency risk using a forward contract at nil cost for settlement on 31 March 20X4.

* The transaction was correctly treated as a cash flow hedge in accordance with IAS 39 Financial Instruments: Recognition and Measurement.

On 31 December 20X3, the financial year end, the fair value of the forward contract was $10,000 (asset).

How should the increase in the fair value of the forward contract be treated within the financial statements for the year ended 31 December 20X3?

* A company expected to agree a foreign currency transaction in January 20X4 for settlement on 31 March 20X4.

* The company hedged the currency risk using a forward contract at nil cost for settlement on 31 March 20X4.

* The transaction was correctly treated as a cash flow hedge in accordance with IAS 39 Financial Instruments: Recognition and Measurement.

On 31 December 20X3, the financial year end, the fair value of the forward contract was $10,000 (asset).

How should the increase in the fair value of the forward contract be treated within the financial statements for the year ended 31 December 20X3?

Question 2

A company's current profit before interest and taxation is $1.1 million and it is expected to remain constant for the foreseeable future.

The company has 4 million shares in issue on which the earnings yield is currently 10%. It also has a $2 million bond in issue with a fixed interest rate of 5%.

The corporate income tax rate is 20% and is expected to remain unchanged.

Which of the following is the best estimate of the current share price?

The company has 4 million shares in issue on which the earnings yield is currently 10%. It also has a $2 million bond in issue with a fixed interest rate of 5%.

The corporate income tax rate is 20% and is expected to remain unchanged.

Which of the following is the best estimate of the current share price?

Question 3

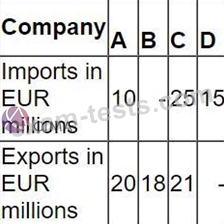

Companies A, B, C and D:

* are based in a country that uses the K$ as its currency.

* have an objective to grow operating profit year on year.

* have the same total levels of revenue and cost.

* trade with companies or individuals in the eurozone. All import and export trade with companies or individuals in the eurozone is priced in EUR.

Typical import/export trade for each company in a year are as follows:

Which company's growth objective is most sensitive to a movement in the EUR/K$ exchange rate?

* are based in a country that uses the K$ as its currency.

* have an objective to grow operating profit year on year.

* have the same total levels of revenue and cost.

* trade with companies or individuals in the eurozone. All import and export trade with companies or individuals in the eurozone is priced in EUR.

Typical import/export trade for each company in a year are as follows:

Which company's growth objective is most sensitive to a movement in the EUR/K$ exchange rate?

Question 4

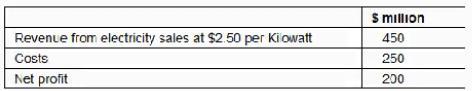

A company generates and distributes electricity and gas to households and businesses.

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $2.00 per Kilowatt.

The company expects this to cause consumption to rise by 15% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to:

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $2.00 per Kilowatt.

The company expects this to cause consumption to rise by 15% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to:

Question 5

A company is concerned that a high proportion of its debt portfolio consists of variable rate finance with an interest rate of LIBOR ' 1 .0%.

It is considering using an interest rate swap to reduce interest rate risk out is concerned about additional finance cost this might create.

A bank has quoted swap rates of 3% 3.5% against LIBOR.

A bank has quoted swap rates of 3% 3.5% against LIBOR.

Is an interest rate swap likely to be beneficial to the company at current LIBOR rates?

It is considering using an interest rate swap to reduce interest rate risk out is concerned about additional finance cost this might create.

A bank has quoted swap rates of 3% 3.5% against LIBOR.

A bank has quoted swap rates of 3% 3.5% against LIBOR.

Is an interest rate swap likely to be beneficial to the company at current LIBOR rates?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: