Question 11

RR has agreed to sell goods to XX for S20.000 XX will pay when the goods are delivered in 6 months time.

RR's home currency is the £- The current exchange rate is 4.3 £/S. The projected inflation rate for the S is

2.8%, and for the E 4 6%.

When RR receives payment for its goods, what will the value be to the nearest pound?

RR's home currency is the £- The current exchange rate is 4.3 £/S. The projected inflation rate for the S is

2.8%, and for the E 4 6%.

When RR receives payment for its goods, what will the value be to the nearest pound?

Question 12

Providers of debt finance often insist on covenants being entered into when providing debt finance for companies.

Agreement and adherence to the specific covenants is often a condition of the loan provided by the lender.

Which THREE of the following statements are true in respect of covenants?

Agreement and adherence to the specific covenants is often a condition of the loan provided by the lender.

Which THREE of the following statements are true in respect of covenants?

Question 13

A company plans to raise finance for a new project.

It is considering either the issue of a redeemable cumulative preference share or a Eurobond.

Advise the directors which of the following statements would justify the issue of preference shares over a bond?

It is considering either the issue of a redeemable cumulative preference share or a Eurobond.

Advise the directors which of the following statements would justify the issue of preference shares over a bond?

Question 14

A company generates and distributes electricity and gas to households and businesses.

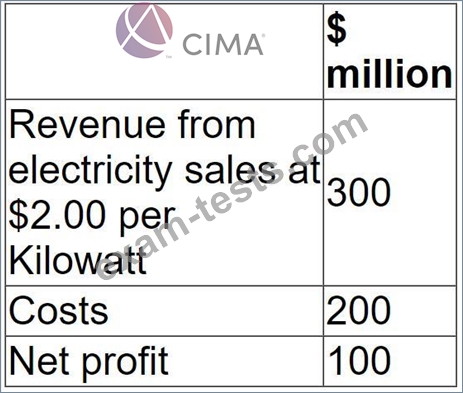

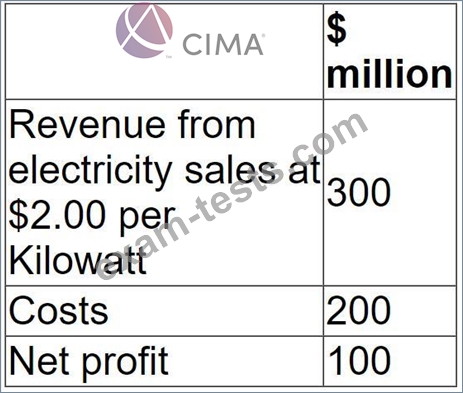

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $1.50 per Kilowatt.

The company expects this to cause consumption to rise by 10% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to:

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $1.50 per Kilowatt.

The company expects this to cause consumption to rise by 10% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to:

Question 15

Company T is a listed company in the retail sector.

Its current profit before interest and taxation is $5 million.

This level of profit is forecast to be maintainable in future.

Company T has a 10% corporate bond in issue with a nominal value of $10 million.

This currently trades at 90% of its nominal value.

Corporate tax is paid at 20%.

The following information is available:

Which of the following is a reasonable expectation of the equity value in the event of an attempted takeover?

Its current profit before interest and taxation is $5 million.

This level of profit is forecast to be maintainable in future.

Company T has a 10% corporate bond in issue with a nominal value of $10 million.

This currently trades at 90% of its nominal value.

Corporate tax is paid at 20%.

The following information is available:

Which of the following is a reasonable expectation of the equity value in the event of an attempted takeover?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: