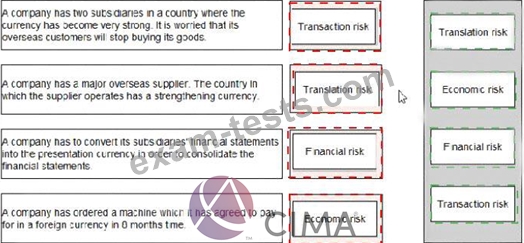

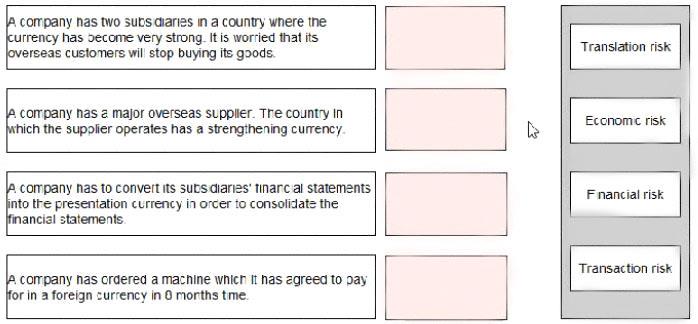

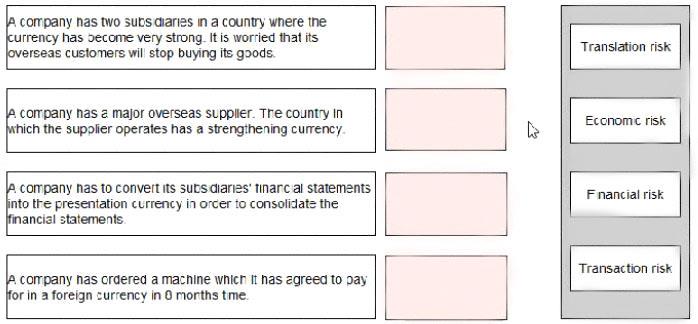

Question 16

Select the category of risk for each of the descriptions below:

Question 17

A major energy company, GDE, generates and distributes electricity in country A.

The government of country A is concerned about rising inflation and has imposed price controls on GDE, limiting the price it can charge per unit of electricity sold to both domestic and commercial customers. It is likely that price controls will continue for the foreseeable future.

The introduction of price controls is likely to reduce the profit for the current year from $3 billion to $1 billion.

The company has:

* Distributable reserves of $2 billion.

* Surplus cash at the start of the year of $1 billion.

* Plans to pay a total dividend of $1.5 billion in respect of the current year, representing a small annual increase as in previous years. However, no dividends have yet been announced.

Which THREE of the following responses would be MOST appropriate for GDE following the imposition of price controls?

The government of country A is concerned about rising inflation and has imposed price controls on GDE, limiting the price it can charge per unit of electricity sold to both domestic and commercial customers. It is likely that price controls will continue for the foreseeable future.

The introduction of price controls is likely to reduce the profit for the current year from $3 billion to $1 billion.

The company has:

* Distributable reserves of $2 billion.

* Surplus cash at the start of the year of $1 billion.

* Plans to pay a total dividend of $1.5 billion in respect of the current year, representing a small annual increase as in previous years. However, no dividends have yet been announced.

Which THREE of the following responses would be MOST appropriate for GDE following the imposition of price controls?

Question 18

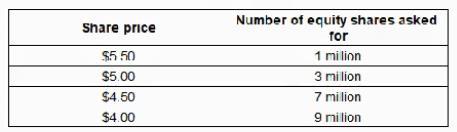

RST wishes to raise at least $40 million of new equity by issuing up to 10 million new equity shares at a minimum price of $3.00 under an offer for sale by tender. It receives the following tender offers:

What is the maximum amount that RST can raise by this share issue?

(Give your answer to the nearest $ million).

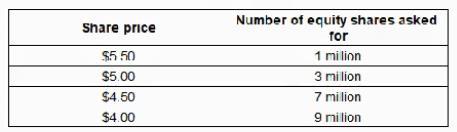

What is the maximum amount that RST can raise by this share issue?

(Give your answer to the nearest $ million).

Question 19

A company has in a 5% corporate bond in issue on which there are two loan covenants.

* Interest cover must not fall below 3 times

* Retained earnings for the year must not fall below $3.5 million

The Company has 200 million shares in issue.

The most recent dividend per share was $0.04.

The Company intends increasing dividends by 10% next year.

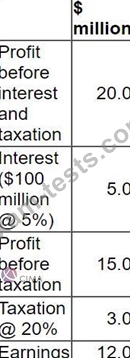

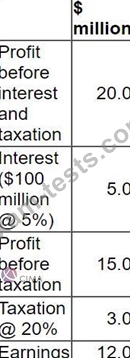

Financial projections for next year are as follows:

Advise the Board of Directors which of the following will be the status of compliance with the loan covenants next year?

* Interest cover must not fall below 3 times

* Retained earnings for the year must not fall below $3.5 million

The Company has 200 million shares in issue.

The most recent dividend per share was $0.04.

The Company intends increasing dividends by 10% next year.

Financial projections for next year are as follows:

Advise the Board of Directors which of the following will be the status of compliance with the loan covenants next year?

Question 20

A company currently has a 5.25% fixed rate loan but it wishes to change the interest style of the loan to variable by using an interest rate swap directly with the bank.

The bank has quoted the following swap rate:

* 4.50% - 455% in exchange for Libor

Libor is currently 4%.

If the company enters into the swap and Libor remains at 4%. what will the company's interest cost be?

The bank has quoted the following swap rate:

* 4.50% - 455% in exchange for Libor

Libor is currently 4%.

If the company enters into the swap and Libor remains at 4%. what will the company's interest cost be?