Question 21

A company intends to sell one of its business units, Company R by a management buyout (MBO).

A selling price of $100 million has been agreed.

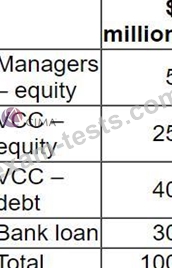

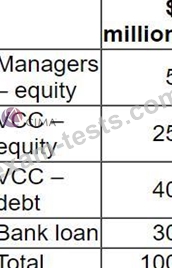

The managers are discussing with a bank and a venture capital company (VCC) the following financing proposal:

The VCC requires a minimum return on its equity investment in the MBO of 30% a year on a compound basis over 5 years.

What is the minimum TOTAL equity value of Company R in 5 years time in order to meet the VCC's required return?

Give your answer to one decimal place.

A selling price of $100 million has been agreed.

The managers are discussing with a bank and a venture capital company (VCC) the following financing proposal:

The VCC requires a minimum return on its equity investment in the MBO of 30% a year on a compound basis over 5 years.

What is the minimum TOTAL equity value of Company R in 5 years time in order to meet the VCC's required return?

Give your answer to one decimal place.

Question 22

The Board of Directors of a small listed company engaged in exploration are currently considering the future dividend policy of the company. Exploration is considered a high-risk business and consequently the company has a low level of debt finance.

Forecasts indicate a period of profit fluctuation in the next few years as the company is planning to embark on a major capital investment project. Debt finance is unlikely to be available due to the project's high business risk.

Which THREE of the following are practical considerations when determining the company's dividend/retention policy?

Forecasts indicate a period of profit fluctuation in the next few years as the company is planning to embark on a major capital investment project. Debt finance is unlikely to be available due to the project's high business risk.

Which THREE of the following are practical considerations when determining the company's dividend/retention policy?

Question 23

A company's annual dividend has grown steadily at an annual rate of 3% for many years. It has a cost of equity of 11%. The share price is presently $64.38.

The company is about to announce its latest dividend, which is expected to be $5.00 per share.

The Board of Directors is considering an attractive investment opportunity that would have to be funded by reducing the dividend to $4.50 per share. The board expects the project to enable future dividends to grow by 5% every year and the cost of equity to remain unchanged.

Calculate the change in share price, assuming that the directors announce their intention to proceed with this investment opportunity.

Give your answer to 2 decimal places.

$ ?

The company is about to announce its latest dividend, which is expected to be $5.00 per share.

The Board of Directors is considering an attractive investment opportunity that would have to be funded by reducing the dividend to $4.50 per share. The board expects the project to enable future dividends to grow by 5% every year and the cost of equity to remain unchanged.

Calculate the change in share price, assuming that the directors announce their intention to proceed with this investment opportunity.

Give your answer to 2 decimal places.

$ ?

Question 24

The directors of a unlisted manufacturing company have prepared a valuation of their company using the price-earning method.

Their calculation is:

Value if the company's equity = $6 million x 10 =$60 million where.

* $6 million is the company's reported profit before interested and tax in the most recent accounting period and

* 10 is the average price-earnings ratio for all listed companies

Which THREE of the following are weakness of this valuation?

Their calculation is:

Value if the company's equity = $6 million x 10 =$60 million where.

* $6 million is the company's reported profit before interested and tax in the most recent accounting period and

* 10 is the average price-earnings ratio for all listed companies

Which THREE of the following are weakness of this valuation?

Question 25

Using the CAPM, the expected return for a company is 11%. The market return is 8% and the risk free rate is

2%.

What does the beta factor used in this calculation indicate about the risk of the company?

2%.

What does the beta factor used in this calculation indicate about the risk of the company?

Premium Bundle

Newest F3 Exam PDF Dumps shared by BraindumpsPass.com for Helping Passing F3 Exam! BraindumpsPass.com now offer the updated F3 exam dumps, the BraindumpsPass.com F3 exam questions have been updated and answers have been corrected get the latest BraindumpsPass.com F3 pdf dumps with Exam Engine here: