Question 51

Company A operates in country A with the AS as its functional currency. Company A expects to receive BS500.000 in 6 months' time from a customer in Country B which uses the B$.

Company A intends to hedge the currency risk using a money market hedge

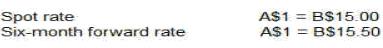

The following information is relevant:

What is the AS value of the BS expected receipt in 6 months' time under a money market hedge?

Company A intends to hedge the currency risk using a money market hedge

The following information is relevant:

What is the AS value of the BS expected receipt in 6 months' time under a money market hedge?

Question 52

A project requires an initial outlay of $2 million which can be financed with either a bank loan or finance lease.

The company will be responsible for annual maintenance under either option.

The tax regime is:

* Tax depreciation allowances can be claimed on purchased assets.

* If leased using a finance lease, tax relief can be claimed on the interest element of the lease payments and also on the accounting depreciation charge.

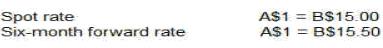

The trainee management accountant has begun evaluating the lease versus buy decision and has produced the following dat

a. He is not confident that all this information is relevant to this decision.

Using only the relevant data, which of the following is correct?

The company will be responsible for annual maintenance under either option.

The tax regime is:

* Tax depreciation allowances can be claimed on purchased assets.

* If leased using a finance lease, tax relief can be claimed on the interest element of the lease payments and also on the accounting depreciation charge.

The trainee management accountant has begun evaluating the lease versus buy decision and has produced the following dat

a. He is not confident that all this information is relevant to this decision.

Using only the relevant data, which of the following is correct?

Question 53

A company currently has a 6.25% fixed rate loan but it wishes to change the interest style of the loan to variable by using an interest rate swap directly with the bank.

The bank has quoted the following swap rate:

* 5.50% - 5.55% in exchange for LIBOR

LIBOR is currently 5%.

If the company enters into the swap and LIBOR remains at 5%, what will the company's interest cost be?

The bank has quoted the following swap rate:

* 5.50% - 5.55% in exchange for LIBOR

LIBOR is currently 5%.

If the company enters into the swap and LIBOR remains at 5%, what will the company's interest cost be?

Question 54

A UK company enters into a 5 year borrowing with bank P at a floating rate of GBP Libor plus 3%

It simultaneously enters into an interest rate swap with bank Q at 4.5% fixed against GBP Libor plus 1.5%

What is the hedged borrowing rate, taking the borrowing and swap into account?

Give your answer to 1 decimal place.

It simultaneously enters into an interest rate swap with bank Q at 4.5% fixed against GBP Libor plus 1.5%

What is the hedged borrowing rate, taking the borrowing and swap into account?

Give your answer to 1 decimal place.

Question 55

An unlisted company wishes to obtain an estimated value for its shares in anticipation of a private sale of a large parcel of shares.

Relevant data for the unlisted company:

* It has a residual dividend policy.

* It has earnings that are highly sensitive to underlying economic conditions.

* It is a small business in a large industry where there are listed companies but there are none with a similar capital structure.

The company intends to base valuations on the cost of equity of a proxy company after adjusting for any differences in capital structure where appropriate.

Which of the following methods is likely to give the most accurate equity value for this unlisted company?

Relevant data for the unlisted company:

* It has a residual dividend policy.

* It has earnings that are highly sensitive to underlying economic conditions.

* It is a small business in a large industry where there are listed companies but there are none with a similar capital structure.

The company intends to base valuations on the cost of equity of a proxy company after adjusting for any differences in capital structure where appropriate.

Which of the following methods is likely to give the most accurate equity value for this unlisted company?